Although there is no shortage of challenges, mechanical engineering and metalworking industry in Latvia continue to evolve also under the circumstances of Covid. The year of 2020 was complicated for mechanical engineering and metalworking industry, since, similarly to all the other industries, ours was also affected by the Covid-19 crisis. However, in general, according to the provisional data of the CSB, turnover and exports in 2020 remained at the same level as in the previous year. This is a positive trend, since the rest of Europe faced on average 10% decline in volumes in the engineering industries. The most complicated moment came in the spring of 2020, when the pandemic and restrictions related thereto began, there was a huge uncertainty and confusion as to the possible future operational scenarios. Companies related to automotive industry faced it the most direct way. Many companies supplying components for automotive industry were forced to remain idle for nearly two months, since their customers in Europe had stopped the operations. Of course, majority of the companies faced logistics problems. However, the positive factor was ability of the industry to re-orientate themselves in the situation and fully restore manufacturing. Growth has resumed from the summer months of 2020, and manufacturing and exports again exceed indicators of previous years. Growth continues also in 2021, and we expect that the year will end with 14–15% increase in turnover and exports.

At the level of companies, situation is different. This is what happens both during the periods of stability and, moreover, during crisis. Caljan should be mentioned as a company with the most impressive increase in volumes. At the end of 2020, operation was commenced in the new production unit placed in the territory of the defunct company Liepājas metalurgs, however, due to increase in volumes, the new premises are already too tight, and arrangement of additional manufacture premises are planned. Whereas, increase in online sales under the impact of pandemic has caused unforeseen demand for the company’s products – telescopic conveyors used by such logistics and online trade companies as Amazon.com and other. In 2020, Caljan saw turnover increase by 8.4 million EUR or 37%. Volumes in 2021 are expected to increase. Other companies of this industry also rapidly develop and expend in Liepāja, thus making it the hotspot from the investment viewpoint.

Although one of the major companies of the industry, Bucher Municipal, faced problems related to component supplies caused by Covid crisis in 2020 and decline in turnover on annual basis, it continues evolving and invest in new technologies and efficiency increase. Gradually greater emphasis is placed on environmentally friendly manufacturing of utility machinery, equipped with electric motors.

In 2021, another widely known international brand Karcher has entered Latvia with plans to develop manufacturing of utility machinery. A production unit near Jelgava has been purchased, and additional investments will be made in the upcoming years, therefore, prospectively, there will be two international companies of similar profile in Latvia.

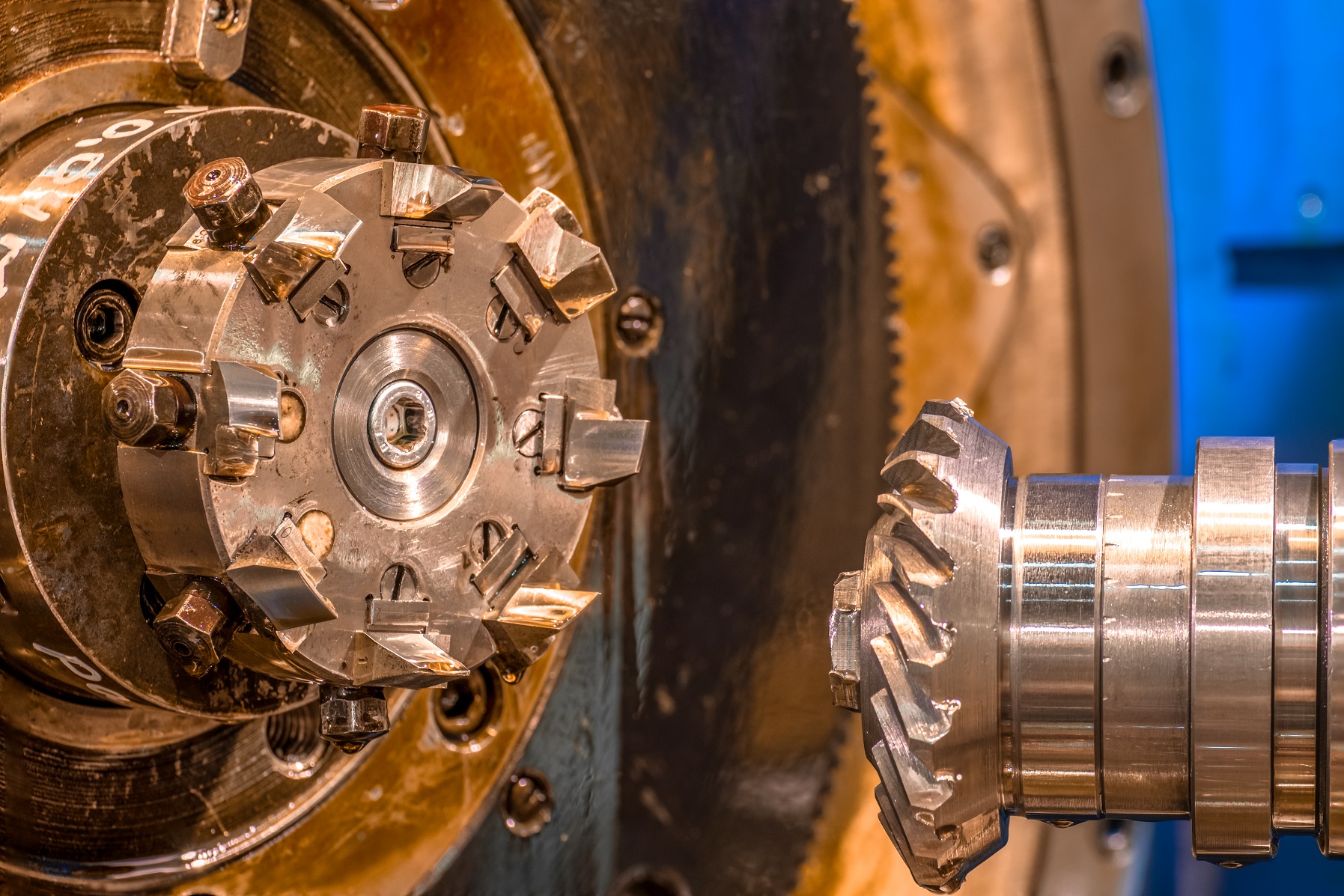

Development and investments continue also in the companies focused on sub-supplier activity. One of the fastest growing companies in the recent years, EMJ Metāls, has expanded both the production premises and machinery part by several large-size sheet processing machines (folding, laser-cutting). Several new companies focusing on precise mechanical processing have entered the market – Exigum, Anttrom – and rapidly gain force.

In general, load of the companies in this industry may be assessed as very high, with many of the companies facing shortage of capacity and human resources to fulfil all the potential orders. It is hard to prove it with statistical data, but it is clear that certain part of the additional volume reaching the sectoral companies has been caused by review of global supply chains, mainly by the European customers moving the orders from China and other far regions back to Europe, thus increasing safety of supplies and facilitating logistics.

Along with the Covid crisis, new problems and challenges have appeared, while the classic long-term problems have not disappeared, with shortage of qualified employees being the problem No. 1. It applies to the employees of all levels and specialities – from welders and CNC workbench specialists to engineers and constructors.

Since the second half of 2020, increase in costs has a gradually increasing impact. Initially, these were the metal prices. During the period from July 2020 to March 2021, steel price grew approximately three times. Furthermore, serious problems related to accessibility of materials were faced. Whereas, this year, everybody has been facing a dramatic increase in energy prices. Mechanical engineering and metalworking industry are not among the most energy-consuming industries, however, increase in costs immensely affects profitability of the companies, especially in relation to the companies with energy-consuming manufacturing processes, such as cast, thermal and surface processing technologies.

Costs of energy resources, problems related to supply of material and components, and shortage of specialists – these are the currently most significant problems not only in Latvia, but also in the entire Europe.

Overall, the industry has been showing stable growth rates for a continuous period of time. Except for 2020, when volumes were equal to the level of the previous year, annual average growth rates exceed 10%. Furthermore, according to the official statistics, more rapidly than turnover and export indicators, grows the added value. Number of employees grows in stable manner, but slowly. All these factors combined show positive trends in productivity indicators.

Our look to 2022 is optimistic, still keeping in mind the problems related to resource prices and qualified labour force.