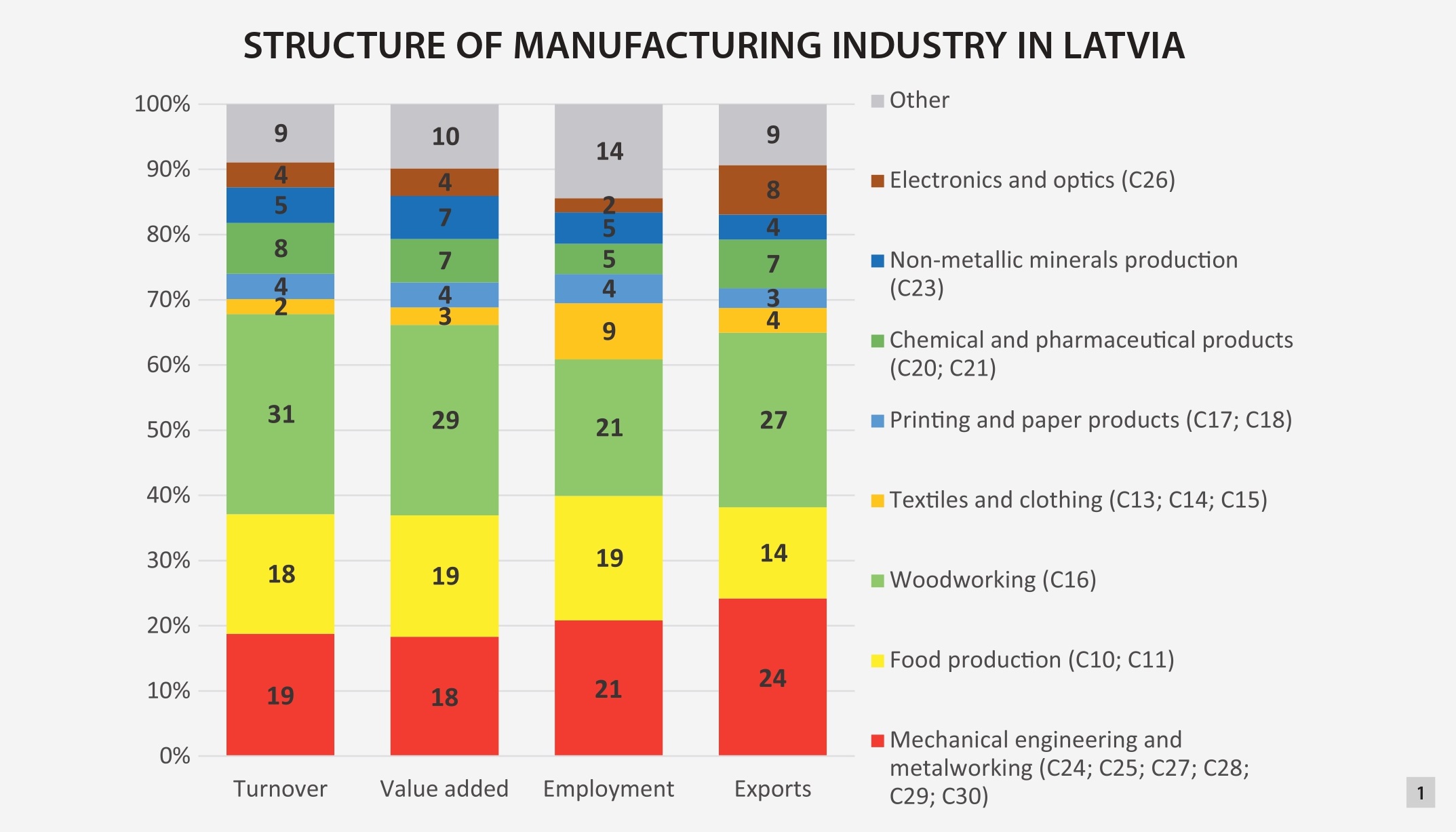

Mechanical engineering and metalworking is one of the leading industries in Latvia.

Sector provide 19% of total manufacturing turnover and 24% of total exports of goods.

Structure of manufacturing industry in Latvia, % of total manufacturing

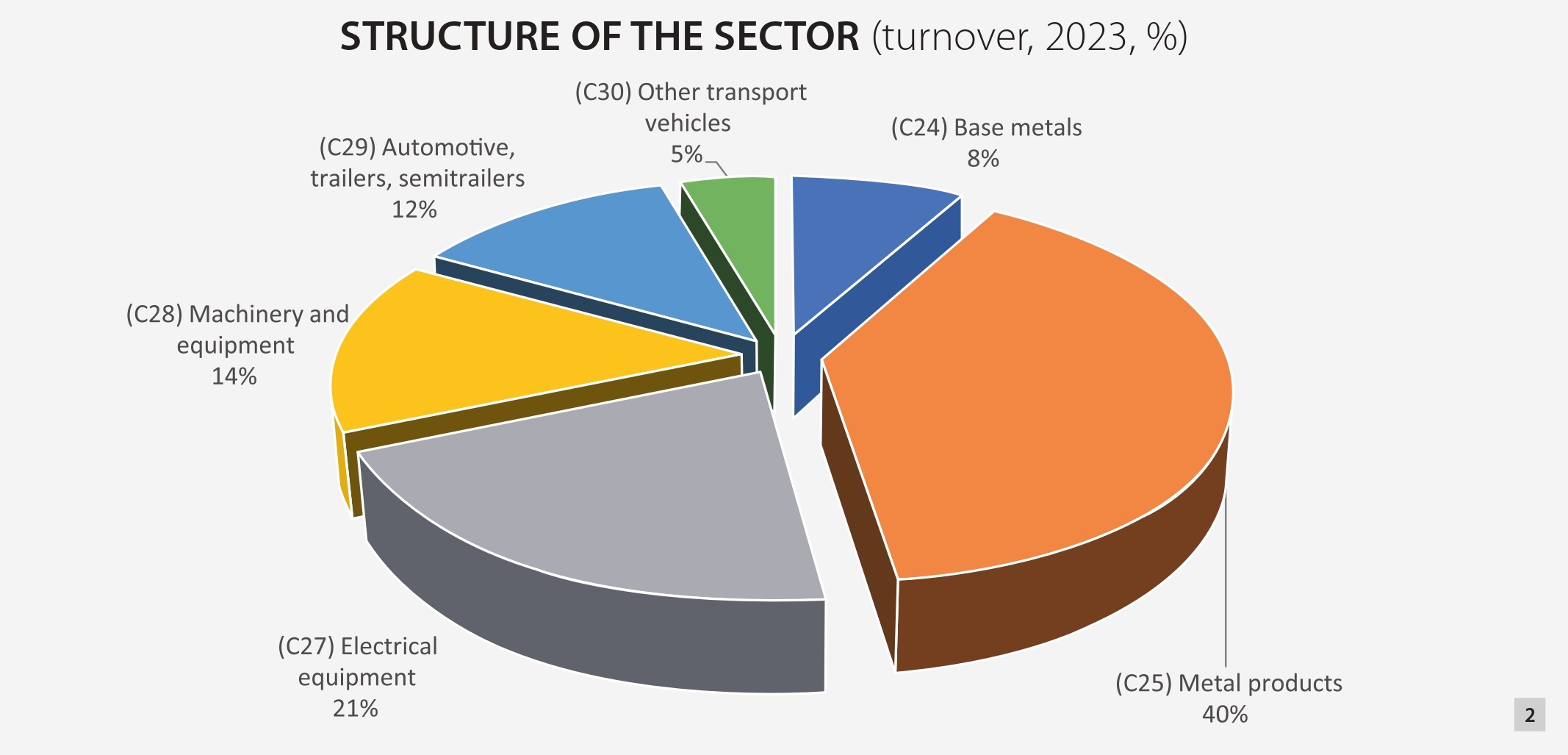

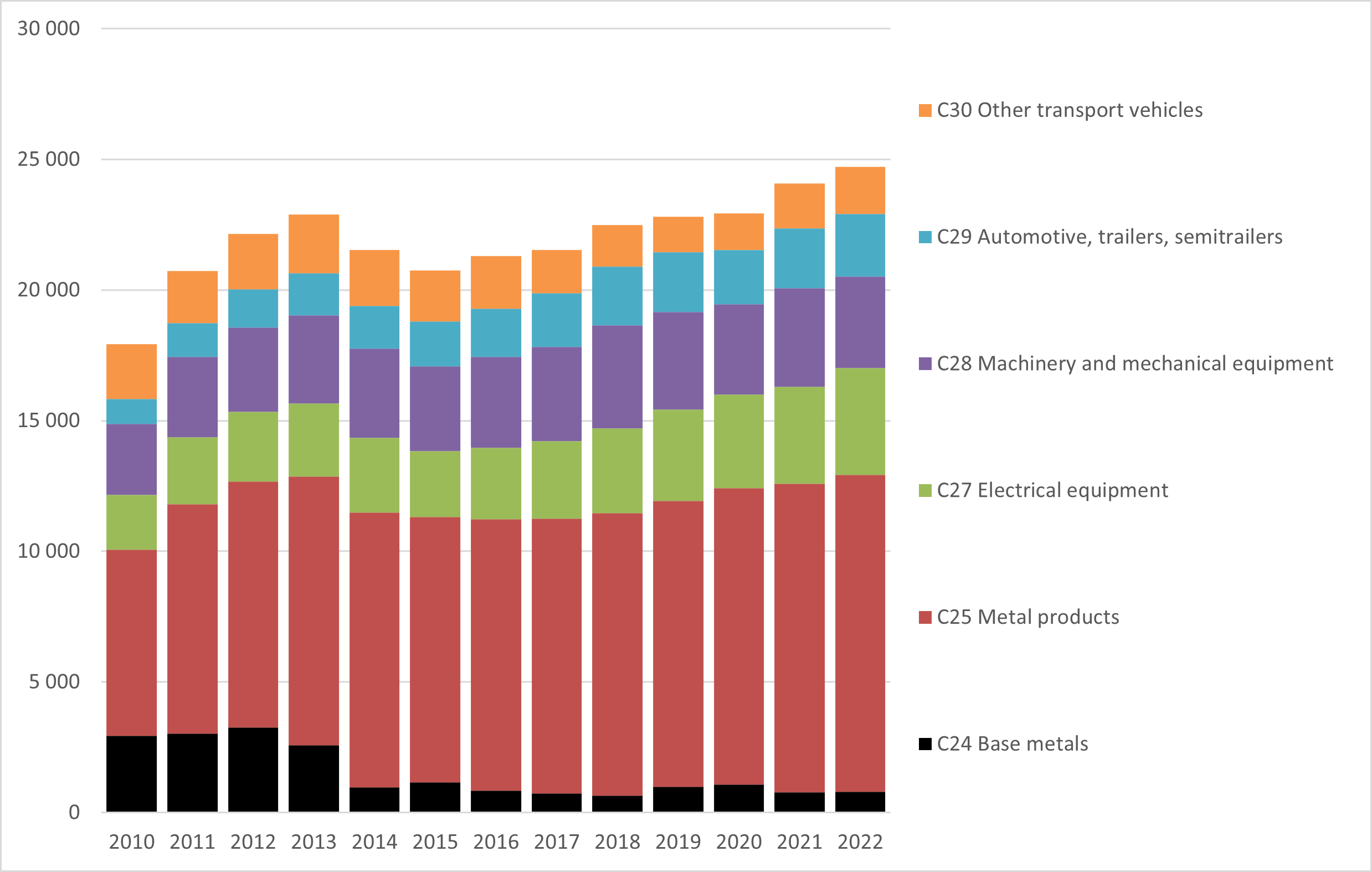

Structure of the Industry

When reffering to Mechanical engineering and metalworking sector the following branches according to NACE2 classification are taken into account:

- C24 - Manufacture of basic metals

- C25 - Manufacture of fabricated metal products, except machinery and equipment

- C27 - Manufacture of electrical equipment

- C28 - Manufacture of machinery and equipment n.e.c.

- C29 - Manufacture of motor vehicles, trailers and semi-trailers

- C30 - Manufacture of other transport equipment

The analysis does not include data on such lines of action as repair of equipment, production of electronic and optical products, as well as recycling that are also closely related to the engineering and metalworking industry.

Structure of mechanical engineering and metalworking industry, 2023

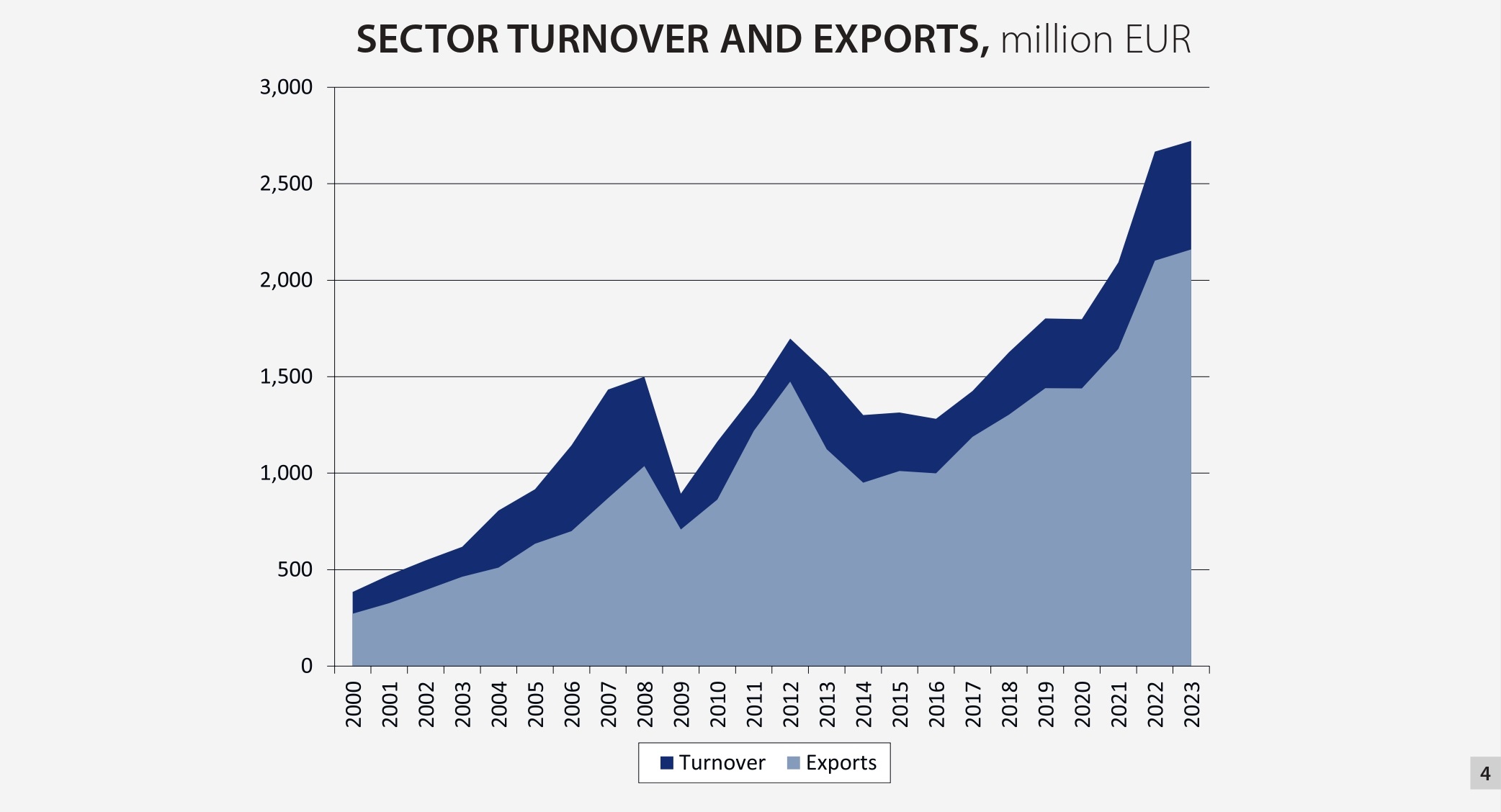

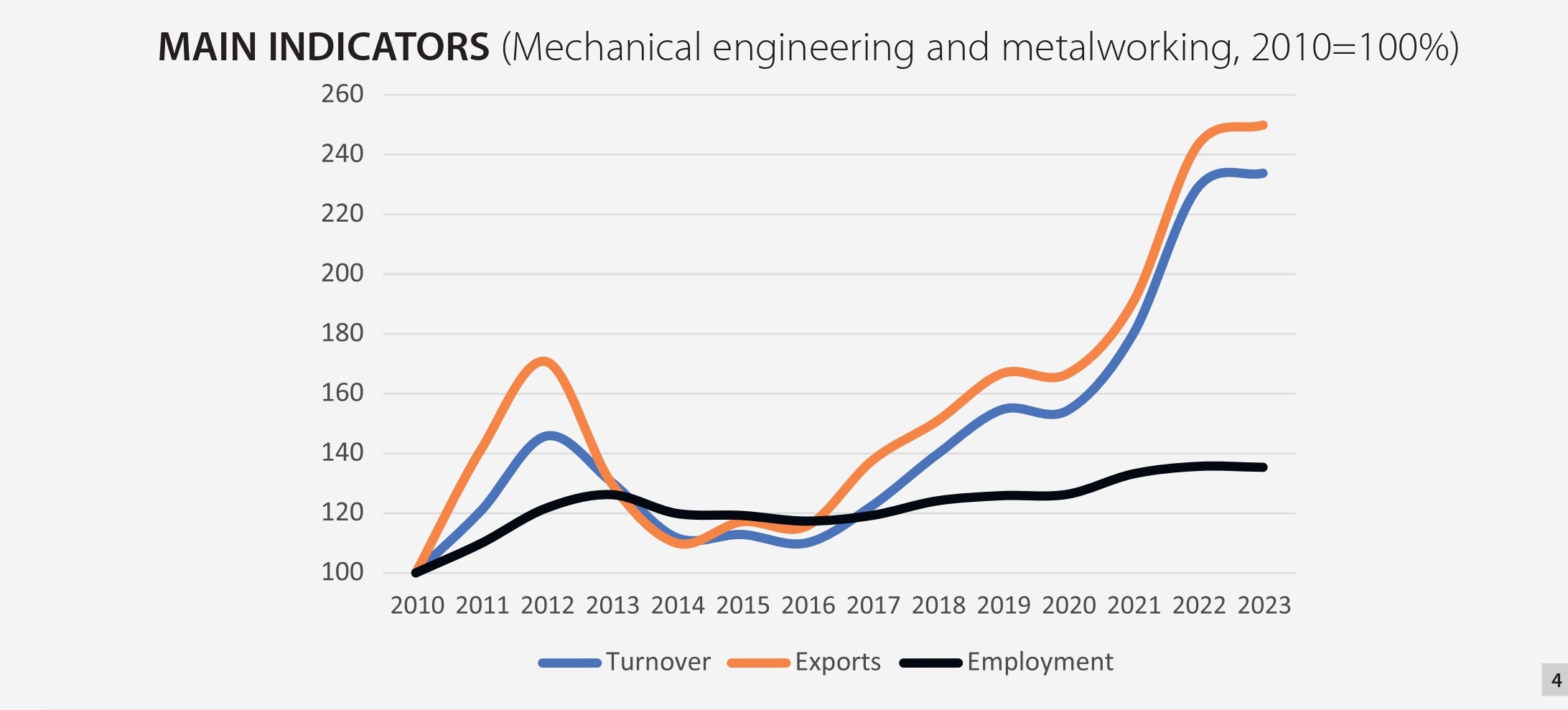

Dynamic of the Industry’s development

Until the end of 2008, mechanical engineering and metalworking was one of the fastest growing sectors of the Latvian, presenting an average annual increase of around 20%. Development was based on active trade in external markets as well as domestic demand. One of the factors influencing the development is the technology upgrade that actively was implemented in 2004 and 2005, including the co-financing by EU funds.

Due to the global economic crisis the year of 2009 was hard for the sector of mechanical engineering not only Latvia, but also throughout the Europe. Production volumes in Latvia in 2009 had decreased by about 40%, affecting almost all sub-sectors. The main influencing factors were the fall in demand for investment goods in other sectors, the production volume decrease in related sectors of foreign markets, falling demand in the internal market, including construction sector. The fall in the domestic market was especially big, thus the proportion of export in product sales in industry in 2009 exceeded the 80% level.

The lowest point was reached in the summer of 2009 and early 2010. Since the beginning of 2010 the stabilization of industry has been seen and growth has resumed.

Operational analysis of the statistics shows that in 2010 and 2011, annual growth rates have reached 30%, so in 2011 production levels has reached that existed before the global economic crisis in 2008. By contrast, in 2012 achieved historically the highest production and export volumes in excess of the pre-crisis level were achieved.

The decrease of volumes in 2013 is related to the suspension of the industry's largest company "Liepajas Metalurgs". In 2014 the performance of the industry was adversely affected by the economic and political situation in Russia and subsequent reductions in the volume of exports to this country. The evaluation of results for the 2015 made by the MASOC shows that the production and export volumes will remain at the level of previous year, while the total turnover of the sector will increase by 1%.

Production and exports, mechanical engineering and metalworking

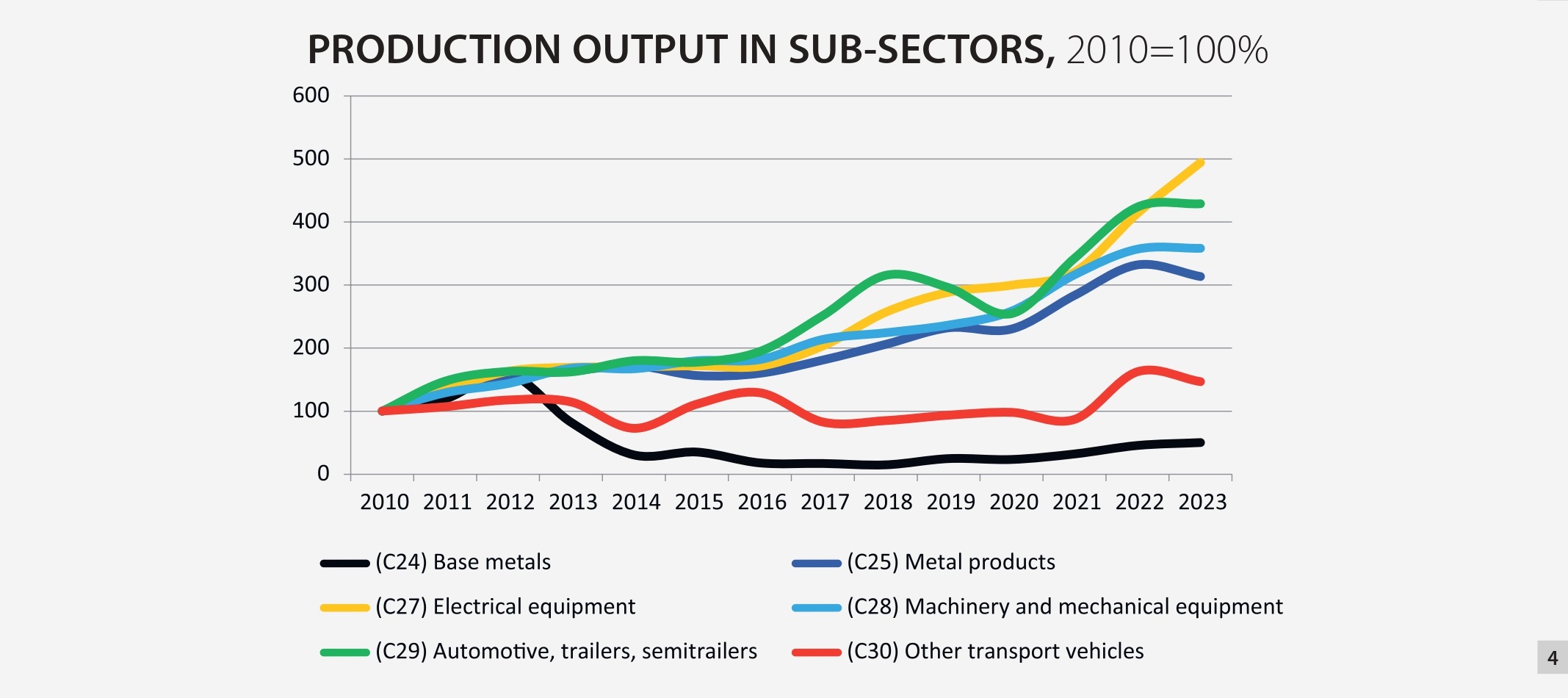

Looking at the pace of development in more detail by the MM sub-sectors shows that the situation differs. Supply to the car industry is one of the fastest growing sub-segments since 2005. This segment is linked to large-scale foreign direct investment.

Production output in subsectors, 2010=100%

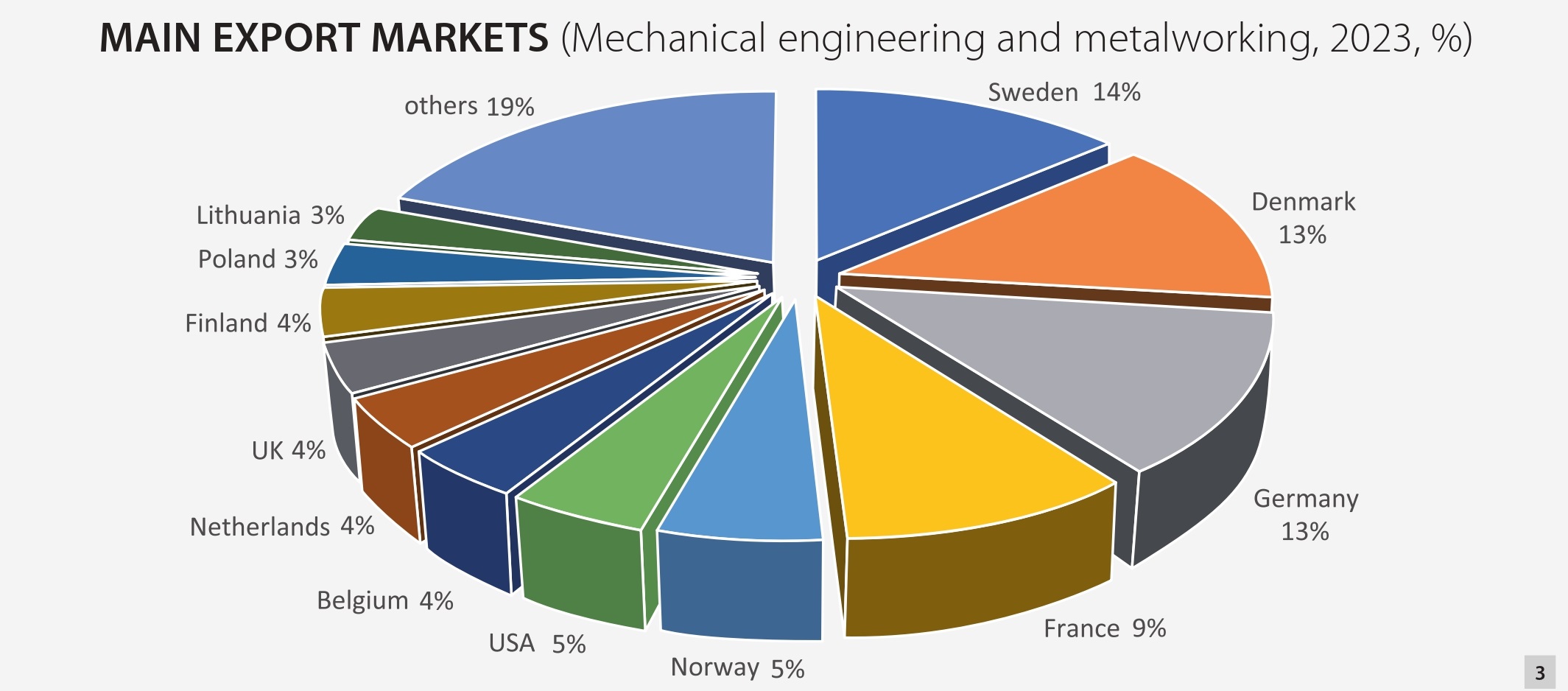

Export markets

Mechanical engineering and metalworking industry is highly export-oriented, on average, around 75-80% of its production is exported. According to the Latvia’s foreign trade statistics, industry products are exported to more than 100 countries of the world, therefore the export market has very wide geography. Overall, around 73% of production is sold in countries of the European Union.

Main export markets, mechanical engineering and metalworking, 2023, % of total exports

Employment

Employment figures in general have similar trends as the ones the overall economic development of the industry have. The employment rate is affects by global economic processes too; therefore the changes largely are correlating with other indicators such as the total turnover and export. However, along with rise in business efficiency and technological modernization, productivity rates gradually increases and thus employment growth lags behind the growth rates of turnover and value added. Nevertheless, the qualified professionals in the industry are in demand and their availability should be named as one of the main priorities.

Employment in mechanical engineering and metalworking

2 Estimate by MASOC based on operational statistics by Central Statistical Bureau of Latvia

3 Data prepared by Central Statistical Bureau of Latvia upon request by MASOC. Includes data only for companies whose primary activity is manufacturing

4 2000-2022 data by Central Statistical Bureau of Latvia. 2023 - Estimate by MASOC based on operational statistics by Central Statistical Bureau of Latvia